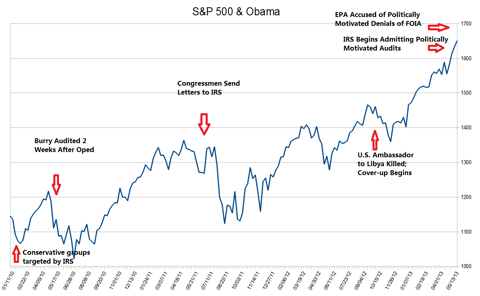

The unfolding IRS scandal, Benghazi cover-up and DOJ investigation of reporters have caused a major headache for the Obama Administration. While there's no clear evidence of White House involvement in the IRS scandal as of yet, the political targeting of at least hundreds, if not thousands of groups and individuals is unlikely to leave the Executive Branch unscathed. The Benghazi story is also likely to hit some members of the Executive as well, most likely in the State Department (based on current evidence).

But will anything come of it? Every two-term President has enough time for himself or his subordinates to violate federal laws and scandal has been a permanent feature at least since Nixon. Iran-Contra, Whitewater and the Valerie Plame affair are just the more prominent scandals, but plenty of smaller ones are quickly forgotten. So why do some scandals force presidents from office or effectively shut down their administration with investigations, and others don't? The answer may not lie in the nature of the crimes, rather in the current state of social mood.

Socionomics is the study of social mood driven events and it operates on the theory that social mood causes events, not the other way around. It assumes the arrow of causation runs from mood to action, whereas the common wisdom assumes events drive mood.

Socionomics predicts that people in a negative mood will shop less, will not expand their business, will be discontent with the government. In contrast, people in a positive mood will shop more, expand their business and approve of the government. Happy people watch comedies, scared people prefer horror, sad people watch tearjerkers. Common wisdom assumes the opposite: sad people listen to happy music to cheer them up, or a stock market crash causes people to get into a bad mood. Sci-fi movies seem to dominate periods of positive social mood, while fantasy dominates periods of negative mood. (The Hobbit was created and written during the 1930s bear market and cartoon versions of it and Lord of the Rings were made in the 1970s bear market and the live action movies were a hit in the 2000s bear market.) For many examples, see Popular Culture and the Stock Market (may require free sign-up).

In politics, social mood can determine whether a president has high or low approval ratings, and whether he is re-elected. A president doesn't necessarily do anything that causes him to be liked or disliked: people are in a positive or negative mood and this reflects onto the president.

The best measure of social mood has been the stock market (social media may be able to replace the stock market as a mass mood indicator) because millions of people are actively participating in the market every day, making millions of decisions. Optimism leads to buying and rising P/E ratios, pessimism leads to selling and falling P/E ratios.

Regarding elections, Robert Prechter co-authored the paper: Social Mood, Stock Market Performance and U.S. Presidential Elections: A Socionomic Perspective on Voting Results. The study found that the change in the stock market during a president's term is a good indicator of whether he will be re-elected. This explains why people predicting Obama's loss based on statistics such as unemployment got it wrong, while those looking at the stock market got it right.

Taking it to a deeper level, the stock market can also tell us whether a president's scandals will become a burden and potentially force him from office, or whether the public will forgive his mistakes because every president has scandals, but what determines the final political outcome is social mood. Rising mood means presidents survive their scandals, falling mood means presidents may be brought down by scandal.

If social mood continues rising, reflected by the stock market rally since 2009, then President Obama will meet popular approval even if he is personally involved in one or more of these scandals. Cabinet officials will survive as well, and only in clear cut cases of lawbreaking will even low level officials face serious punishment.

Conversely, if the stock market rally ends and the bear market returns (signaling a decline in social mood), it becomes more likely that a low level officials will go to jail. High level cabinet officials could also face legal sanction and their political careers may suffer as a result. In the worst case, the president may face articles of impeachment.

To summarize: presidential popularity is based on social mood, which itself drives the stock market and the economy. When people are optimistic, they let even egregious political scandals slide as their happiness is reflected off their president. When they are in a negative mood and sending the economy and stocks lower, they will blame their president even if he bears zero responsibility.

Why it matters

Investors who use forecasts of government policy to influence investment decisions can gain an advantage if they can forecast the political outcome months or years in advance.

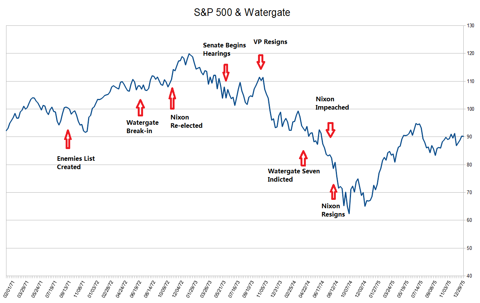

Here are a few examples of how scandals played out in the past. First is Nixon:

Watergate was a public story in 1972, but Nixon went on to a landslide victory with stocks rallying from their 1970 lows. Unfortunately for Nixon, social mood went on to peak shortly after his reelection and voters threw him out at the same time investors were throwing stocks out of their portfolios. Stocks fell more than 40 percent from their peak in 1973 to their trough in 1974. To give you an idea of all the negative events taking place at this time:

The 1973-1974 bear market was a bear market that lasted between January 1973 and December 1974. Affecting all the major stock markets in the world, particularly the United Kingdom,[1] it was one of the worst stock market downturns in modern history.[2] The crash came after the collapse of the Bretton Woods system over the previous two years, with the associated 'Nixon Shock' and United States dollar devaluation under the Smithsonian Agreement. It was compounded by the outbreak of the 1973 oil crisis in October of that year. It was a major event in the 1970s recession.

Social mood was negative and it was global, with conflicts erupting around the globe. Common wisdom blames these events for mood, but Socionomics tells us Bretton Woods broke down at that time because of negative mood. When people are in a positive mood, they will try to keep a system going. When they are in a negative mood they will defect from the system. See the EU and eurozone today for an unfolding example.

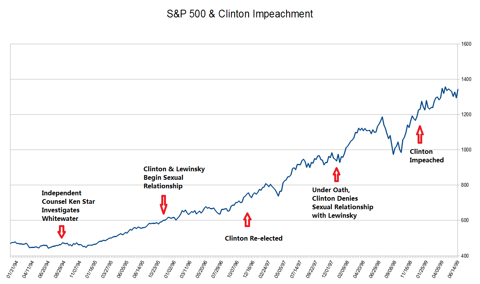

In contrast to Nixon, look at President Clinton's brush with impeachment:

Republicans thought they had the goods on President Clinton, but the public didn't care. They held on to Clinton and their stocks all the way into 2000. During this era, the WTO, NAFTA and the euro were launched in the midst of a global economic boom. It was the polar opposite to the 1970s in terms of social mood.

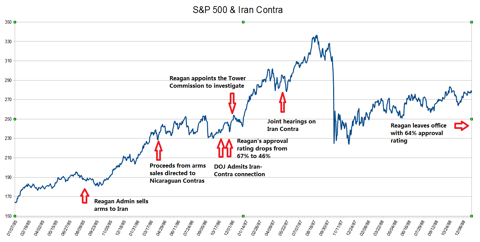

How about Iran-Contra? There was a stock market crash after all......

Iran-Contra came in the midst of a bull market and even though the market crashed, the crash was a short-lived affair-stocks didn't go into a bear market.

Now here's President Obama:

Obama administration scandals are just starting with the market at multi-year highs. There is enough scandal to drive Congressional investigations that will keep these scandals alive for months, if not longer. Therefore, the movement in the stock market could play a crucial role in how the public ultimate views these scandals. From the evidence I've seen, such as Michael Burry's commencement address in 2012 where has says he was audited week after this op-ed appeared in the NYTimes: I Saw the Crisis Coming. Why Didn't the Fed?, it appear the IRS scandal is much wider than presently thought and includes the targeting of individuals who publicly criticized any government policy.

Political Forecasts

Social mood will determine whether the public wants lawbreakers hunted down and punished, or whether they'd rather see Congress get back to business. Iran-Contra was serious, it caused Reagan's approval rating to fall, but ultimately people were in a positive mood. President Clinton lied under oath, but the social mood was even more ebullient in 1998. Republicans were completely out of step with the social mood and ended up harming themselves with impeachment. In contrast, Nixon's scandal broke during the 1970s bear market and social mood deteriorated as the scandal unfolded.

For investors, there are lots of issues at stake. The Federal Reserve's policies are increasingly unpopular with Republicans in Congress. Obamacare is set to take effect in 2014, but Republicans have a bills to delay its implementation or repeal it. Green energy and the Keystone Pipeline will be affected by the perceived strength or weakness of the Obama administration. In short, the world could be a very different place in 2015 if social mood changes course. Obamacare may be delayed and Republican led tax reform could be a major issue before Congress, or Obamacare could be the law of the land with current policies continuing until the end of Obama's term.

If the market continues rising, the scandals will be contained. Depending on the facts, officials could face sanction, but it will require intentional lawbreaking. It doesn't matter how much Obama's enemies scream or how justified they are in their pursuit of justice, the public will be in a positive mood and if Republicans press their case, it's likely to be a repeat of Clinton's impeachment.

If social mood is about to turn negative once more, the scandals will have greater impact. A decline from 1700 on the S&P 500 to 1300 over the next year or two will be a greater than 20% loss and the Obama administration will likely be mired in scandal. Washington will be divided by partisan rancor that will continue into the 2016 election. Most of Obama's policies will continue, but new legislation will prove difficult. Mood would favor the GOP in 2014 Congressional elections.

If we see a major bear market on the scale of 1973-1974, with the S&P 500 trading below 1100 in 2014 or 2015, then the Obama administration will be in serious trouble. Even Democrats will abandon the President (many will join Republicans in voting to delay or repeal Obamacare) and any tenuous link between the President and lawbreaking will be inflated into serious violations, if not of the law, then the public trust.

It is very early, but from the initial reports, there seems to be enough smoke to conclude one or more fires are present. If that's the case, the Obama administration will face serious political repercussions should social mood decline. Social mood is currently trending positive, but remains far more negative than at the 2000 peak in the stock market. Impeachment talk is silly at this point, but since I believe a 20% drop stocks is likely in the next 18 months, my outlook for the Obama administration is not bright. Watch the immigration bill, if it is defeated, it will be a sign that social mood is negative and working against Obama. If he can push it through, it doesn't mean he's past the scandals, only that he's still got enough positive momentum to continue pursuing his agenda.

Conclusion

Washington scandals will not drive the stock market lower. The stock market is driven by social mood and will rise or fall based on that mood. Whether a scandal becomes a major historic event or fades into the background will be determined by that social mood.

Investors should consider social mood when analyzing their market forecasts because the stock market is a reflection of mood. Put your political opinion aside and look at it objectively based on your forecast. Unless there is a smoking gun in Obama's hand, he will remain popular through a bull market and scandals will have a dampened effect. If in contrast there is a bear market, even a small scandal can be blown up into a major crisis that weakens the Obama administration.

You can extend the same analysis to foreign policy: if Obama is hamstrung with scandal, U.S. foreign policy is likely to suffer. To Europe: if mood in Europe declines, the UK will leave the EU and the eurozone will break apart. To Asia: if mood in Asia declines, Japan, China, Philippines, Taiwan and Vietnam will increasingly clash over maritime borders. On trade, if global mood declines, the world will increasingly prefer protectionist trade policies, restrict immigration and defect from global governance (such as climate change). If mood becomes positive, all of these trends will reverse and the Doha round of the WTO will move forward.

In sum, the stock market is telling us a lot more about the world than most of us think. It reflects social mood, and that mood can drive culture, politics and the economy.

Of course, a great criticism is that you can't forecast the market, in which case you can't use the market to forecast changes in politics or the economy. However, many investors and traders do make market forecasts and they have confidence in them. I suggest they consider the argument put forth by socionomics, that the information in their forecast is about more than just stock prices.

If you are interested in learning more about socionomics, check out Socionomics: The Science of History and Social Prediction.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/base/copper-d.gif)

No comments:

Post a Comment