2013-05-30

Chinese media: the death of copper financing is greatly exaggerated

Copper financing Times reported Goldman Sachs accused of ulterior motives unspeakable end

In essence, the traders argue that what's going on is arbitrage between the onshore and offshore dollar and yuan exchange rates, in addition to interest rate differentials, and copper is merely one of many options in this trade. The price of copper will determine its use: if prices start falling, traders may be unwilling to sit on inventory. However, none of this deals with the use of copper as collateral for loans.

Wuhan building has exterior walls blown off by the wind

2013-05-28

At first the current stall out of global warming was due to the ocean cycles turning back to cold. But something much more ominous has developed over this period. Sunspots run in 11 year short term cycles, with longer cyclical trends of 90 and even 200 years. The number of sunspots declined substantially in the last 11 year cycle, after flattening out over the previous 20 years. But in the current cycle, sunspot activity has collapsed.I have always believed the fireball the size of 1 million Earths was always a larger determinant in global temperature than the AGW crowd believed. As Vox put it:

Who would have ever imagined that it was the giant flaming ball of nuclear fire in the sky, the one that provides the Earth with the vast majority of its heat, that is the controlling factor concerning global temperatures? What an outlandish notion!Indeed!

The cooling may not be temporary though:

hat report quoted Yuri Nagovitsyn of the Pulkovo Observatory saying, “Evidently, solar activity is on the decrease. The 11-year cycle doesn’t bring about considerable climate change – only 1-2%. The impact of the 200-year cycle is greater – up to 50%. In this respect, we could be in for a cooling period that lasts 200-250 years.” In other words, another Little Ice Age.If CO2 does increase temperature, humanity may well decide to increase CO2 output inthe coming decades.

China's coal depression

Rising costs, weak demand harm coal industry

Sublime China Information Co Ltd, which runs the commodities website, www.sci99.com, says the industry continues to suffer from dramatic falls in prices and weak demand, caused by domestic overcapacity and growing imports.

......if the gloomy situation continues in the second half of the year, some medium-scale coal mines will go bankrupt.

Qinhuangdao Coal Inventory Rising By The Day; Small and Medium Firms Trapped (秦皇岛煤炭库存日增 中小贸易商业务几陷停滞)

Qinhuangdao seaborne coal market analyst Meng Hai told reporters that in the past decade, annual Qinhuangdao Datong-Qinhuangdao railway maintenance can cause even the Bohai coal prices rose slightly, "I remember 2010 ton floating around the 40-50 yuan , 2011 ton floating up 30-40 yuan, 2012 ton floating up 10-20 yuan, "but by 2013 that is not risen.It wouldn't take much to cause a break in the market. If speculators and traders operate on the assumption of 8% GDP growth and it slows to 6%, with some greater slowdown in energy intensive sectors, that is enough to break a highly leveraged market operating on razor thin margins. The article notes that the inventories aren't at max capacity yet, but that falling demand has already precipitated a crisis for small and medium firms, with many small firms already out of the market.

Reporters noted that since 2013, Qinhuangdao coal network announced Bohai 5500 kcal coal trading price index has been declining, the price index for the first week of coal per ton, 633 yuan, after basically a week to 2 yuan 1 yuan per ton rate of decline, to May 15 released the latest composite average price has dropped to the level of 612 yuan per ton. Fang and Menghai have said that this year's downward trend in coal prices was relatively unusual. Qinhuangdao seaborne coal market information editing high Lanying also said, "describes the current market demand is weak, is not generally weak."

Coal Market, the Great Depression: up to 500 million tons of excess capacity, government bailout (煤市大萧条:产能过剩达5亿吨 政府出手救市)

To put that in perspective, the Chinese economy consumed 4 billion tons of coal in 2012, which puts excess capacity at about 12% of the market. This is the same situation we saw in steel the past couple of years and it continues: Surging Chinese Steel Exports Put Pressure on World Prices

A surge in Chinese steel production and a flood of exports are pressuring world-wide steel prices despite Beijing's efforts to rein in the industry, in the latest example of the global impact of China's massive industrial overcapacity.Expect a decline in coal imports.

The rise shows the difficulty Beijing's leaders face as they try to retool the world's No. 2 economy to focus more on consumers and services and diversify away from its dependence on manufacturing and big-ticket projects like highways and airports. China makes slightly less than half the world's steel, but Beijing has in recent years tried to cut back smelters that it increasingly views as polluting, low-value and outdated.

Data released this week by state-backed data provider Custeel showed Chinese steel output surged 8.4% in April compared with a year earlier to 65.7 million metric tons, its second-highest level ever. China's steel production reached its latest high in March at 66.3 million tons, rising 7.7% from the year before. The rise comes despite softer-than-expected first-quarter economic growth in China and other sluggish economic readings in recent months.

2013-05-27

First Sweden, Now England: Will This Be The Summer of Reaction?

Now it's all coming home to roost. I have previously said that when the Left calls every person to the right of open borders a racist, they also bring the real racists out from exile and into the mainstream of politics. The tide is starting to turn quickly in England.

Tensions on streets after slaughter of British soldier: War memorials defaced and mosque firebombed as EDL march on Westminster

It's too early to say if the situation will spiral out of control, but it's clear the average man on the street is disillusioned with the establishment in Sweden and the UK. Right-wing, anti-establishment parties are going to gain big from these events and may even be surpassed by farther right parties. I suspect we will see UKIP in England shift to the right as it becomes clear the public is fed up with the immigration policy. It could also devolve into violence because the public trust in government is sinking to new lows, they do not trust the police to act in the interests of the native population.

The Collapse of a Trust

这也迫使安信信托不得已降低投资门槛至20 万元,否则担心没有足够的投资者来“捧场”。

This sentence states that one trust company has been forced to lower the initial investment to 200,000 yuan, otherwise it would be unable to find enough investors. A lot of trusts are only pulling in 40-60% of their initial fundraising targets with investors skittish. The article cites on company with real estate in Dongguan. The city of course is in financial trouble, and investors were unwilling to pony up cash even at 9-10% rates of interest.

Link to Google Translated article: Property Trust rout

AGW Warming Crowd Turns Up The Rhetoric As Scientist Comes Under Attack

Virginia Republicans Nominate Anti-Science Candidate for Governor

Last week, the Virginia Republican party nominated Ken Cuccinelli for governor, in an election to be held later this year. Just three years ago, in his current job as Attorney General of Virginia, Cuccinelli launched one of the most outrageous attacks on an academic scientist that I’ve seen in many decades. His actions would not be out of place in a totalitarian state such as the Soviet Union, or perhaps in the 1950′s McCarthyism era, when many Americans were blacklisted, denied jobs, and even fired because of their political views. But in a country where the freedom to speak is a fundamental right, Cuccinelli’s actions are frightening.McCarthy! Denial! Blacklist! Ironic that most American universities operate under Stalinist rules. And which university did Cuccinelli target? Not a private institution, but the state funded University of Virginia, where the state and the people clearly have an interest.

Cuccinelli used the power of government to intimidate a scientist with whom he disagreed. Not just one scientist, but 40 scientists and their colleagues, all working at the University of Virginia. His message was clear: if you disagree with me, I will come after you. Now Cuccinelli is running for governor, and in a state fairly evenly split between Republicans and Democrats, he has a good chance of winning.

Ken Cuccinelli is a climate change denialist, one of many U.S. politicians who think that the Earth is not warming, or if it is, that the warming is unrelated to human activities. The science is completely against Cuccinelli on this, but if he were simply scientifically ignorant I wouldn’t be writing about him. After all, he’s not the only politician who ignores science when he finds it inconvenient.

Who did Cuccinelli go after? None other than the fraud of AGW, Michael "Hockeystick" "Hide The Decline" Mann.

ClimateGate Star Michael Mann Courts Legal Disaster

In an e-mail sent to Mann and others, CRU’s director Philip Jones reported: “I’ve just completed Mike’s Nature [journal] trick…to hide the decline [in global temperatures].” “Mike’s” ( Mann’s) “trick” was to add in real temperatures to each series for the last 20 years from 1979 onwards and from 1961 for Briffa’s, show all of the proxy and surface measurement chartings in different colors on a single graph, and then simply cut off Briffa’s in a spaghetti clutter of lines at the 1961 date.This case is not an aberration, but the start of a major trend. Aside from global warming, universities are declining in stature due to debt, cultural Marxism and low standards. Scientists are also coming under increasing scrutiny in areas such as genetics as opposition to genetically modified crops increases on the left. It is the start of a general trend against scientists.

In the wake of ClimateGate e-mail revelations, two universities that have employed Mann have been called to task for insulating him from accusations of wrongdoing. Penn State has been broadly accused of botching an internal inquiry, and Mann is fighting a Freedom of Information Act (FOIA) request seeking to compel the U. of Virginia, his employer during the period in question, to release requested documents. The FOIA was filed by Christopher Horner, Director for Litigation with the American Tradition Institute’s Environmental Law Center.

Number Of Published Cancer Studies That Can't Be Reproduced Is Shockingly High

Any one study may come to an interesting conclusion—"this chemical causes cancer" or "this drug works" or "penis size matters"—but the way scientists check if those studies are true is by doing them over again. When study after study gets the same results, you can be reasonably sure the conclusion is true. On the other hand, large numbers of irreproducible studies in the scientific literature indicate that something's wrong, reported Retraction Watch, a watchdog blog that first pointed us to the new survey.The amount of fraud in science is staggering, but it's largely undiscovered because scientists hold a high social position in society. As social mood changes, the relative position of groups will shift as well. Science itself will also come under increased scrutiny, but the main targets in this social mood shift will be the scientists. They will try to make it seem like science is under attack, which might be the case at times, but overall the targets will be those peddling fraudulent results.

The researchers involved in the irreproducible studies didn't always seem eager to make things right. Sixty-two percent of the survey respondents who tried to contact the original researchers found the study authors responded negatively, indifferently or not at all. Only one in three researchers in the survey, which a team of MD Anderson Cancer Center physicians sent to all scientists at the center, ever resolved the discrepancy they found.

2013-05-25

Gold COTS

Forget Prayer, It's Lamb Slaughter Time: A Rational Man's Response To All Time High Gold Shorts

2013-05-24

China's New Age of Reform

On Friday, the Chinese government also issued a set of policy proposals that appeared to be intended to show that Mr. Li and other leaders were serious about reducing government intervention in the marketplace and giving competition among private businesses a bigger role in investment decisions and setting prices. The overhauls, if successful, could also make China an even stronger competitor on the global stage by encouraging innovation and expanding the middle class.IF you click the Li Keqiang tag on this post you will see that none of this is a surprise. Li Keqiang was expected to be the successor to Wen Jiabao years ago, and he has been writing and speaking about economic reform the entire time.

Whether Beijing can restructure an economy that is thoroughly addicted to state credit and government directives is unclear. But analysts see such announcements as the strongest signs yet that top policy makers are very serious about revamping the nation’s growth model.

“This is radical stuff, really,” said Stephen Green, an economist at the British bank Standard Chartered and an expert on the Chinese economy. “People have talked about this for a long time, but now we’re getting a clearly spoken reform agenda from the top.”

Behind Mr. Li and President Xi Jinping is a group of pro-market bureaucrats who seem to have gained in the leadership shuffle this year, including the central bank chief, Zhou Xiaochuan; Finance Minister Lou Jiwei; and Liu He, who is a vice chairman of the National Development and Reform Commission and director of the Office of the Central Leading Group on Financial and Economic Affairs, a body that advises party leaders on the economy. Mr. Liu is part of a team working on proposals for economic changes that could be announced in the autumn at a meeting of the Communist Party Central Committee.In Socionomics Watch—The battle for China, I looked at the succession battle that ended with the removal of Bo Xilai. The path was cleared for the reformers and while they didn't get as many top leadership spots as they wanted, they did win key posts critical to the reform agenda.

2013-05-23

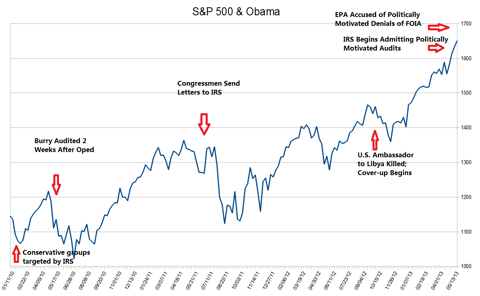

Will Obama Be Impeached? Watch The Stock Market

The unfolding IRS scandal, Benghazi cover-up and DOJ investigation of reporters have caused a major headache for the Obama Administration. While there's no clear evidence of White House involvement in the IRS scandal as of yet, the political targeting of at least hundreds, if not thousands of groups and individuals is unlikely to leave the Executive Branch unscathed. The Benghazi story is also likely to hit some members of the Executive as well, most likely in the State Department (based on current evidence).

But will anything come of it? Every two-term President has enough time for himself or his subordinates to violate federal laws and scandal has been a permanent feature at least since Nixon. Iran-Contra, Whitewater and the Valerie Plame affair are just the more prominent scandals, but plenty of smaller ones are quickly forgotten. So why do some scandals force presidents from office or effectively shut down their administration with investigations, and others don't? The answer may not lie in the nature of the crimes, rather in the current state of social mood.

Socionomics is the study of social mood driven events and it operates on the theory that social mood causes events, not the other way around. It assumes the arrow of causation runs from mood to action, whereas the common wisdom assumes events drive mood.

Socionomics predicts that people in a negative mood will shop less, will not expand their business, will be discontent with the government. In contrast, people in a positive mood will shop more, expand their business and approve of the government. Happy people watch comedies, scared people prefer horror, sad people watch tearjerkers. Common wisdom assumes the opposite: sad people listen to happy music to cheer them up, or a stock market crash causes people to get into a bad mood. Sci-fi movies seem to dominate periods of positive social mood, while fantasy dominates periods of negative mood. (The Hobbit was created and written during the 1930s bear market and cartoon versions of it and Lord of the Rings were made in the 1970s bear market and the live action movies were a hit in the 2000s bear market.) For many examples, see Popular Culture and the Stock Market (may require free sign-up).

In politics, social mood can determine whether a president has high or low approval ratings, and whether he is re-elected. A president doesn't necessarily do anything that causes him to be liked or disliked: people are in a positive or negative mood and this reflects onto the president.

The best measure of social mood has been the stock market (social media may be able to replace the stock market as a mass mood indicator) because millions of people are actively participating in the market every day, making millions of decisions. Optimism leads to buying and rising P/E ratios, pessimism leads to selling and falling P/E ratios.

Regarding elections, Robert Prechter co-authored the paper: Social Mood, Stock Market Performance and U.S. Presidential Elections: A Socionomic Perspective on Voting Results. The study found that the change in the stock market during a president's term is a good indicator of whether he will be re-elected. This explains why people predicting Obama's loss based on statistics such as unemployment got it wrong, while those looking at the stock market got it right.

Taking it to a deeper level, the stock market can also tell us whether a president's scandals will become a burden and potentially force him from office, or whether the public will forgive his mistakes because every president has scandals, but what determines the final political outcome is social mood. Rising mood means presidents survive their scandals, falling mood means presidents may be brought down by scandal.

If social mood continues rising, reflected by the stock market rally since 2009, then President Obama will meet popular approval even if he is personally involved in one or more of these scandals. Cabinet officials will survive as well, and only in clear cut cases of lawbreaking will even low level officials face serious punishment.

Conversely, if the stock market rally ends and the bear market returns (signaling a decline in social mood), it becomes more likely that a low level officials will go to jail. High level cabinet officials could also face legal sanction and their political careers may suffer as a result. In the worst case, the president may face articles of impeachment.

To summarize: presidential popularity is based on social mood, which itself drives the stock market and the economy. When people are optimistic, they let even egregious political scandals slide as their happiness is reflected off their president. When they are in a negative mood and sending the economy and stocks lower, they will blame their president even if he bears zero responsibility.

Why it matters

Investors who use forecasts of government policy to influence investment decisions can gain an advantage if they can forecast the political outcome months or years in advance.

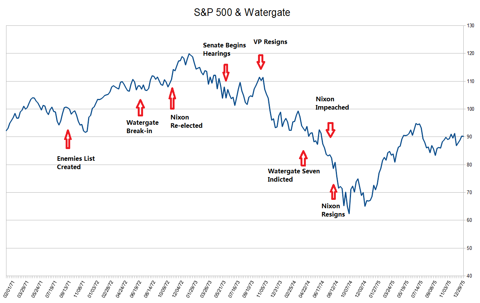

Here are a few examples of how scandals played out in the past. First is Nixon:

Watergate was a public story in 1972, but Nixon went on to a landslide victory with stocks rallying from their 1970 lows. Unfortunately for Nixon, social mood went on to peak shortly after his reelection and voters threw him out at the same time investors were throwing stocks out of their portfolios. Stocks fell more than 40 percent from their peak in 1973 to their trough in 1974. To give you an idea of all the negative events taking place at this time:

The 1973-1974 bear market was a bear market that lasted between January 1973 and December 1974. Affecting all the major stock markets in the world, particularly the United Kingdom,[1] it was one of the worst stock market downturns in modern history.[2] The crash came after the collapse of the Bretton Woods system over the previous two years, with the associated 'Nixon Shock' and United States dollar devaluation under the Smithsonian Agreement. It was compounded by the outbreak of the 1973 oil crisis in October of that year. It was a major event in the 1970s recession.

Social mood was negative and it was global, with conflicts erupting around the globe. Common wisdom blames these events for mood, but Socionomics tells us Bretton Woods broke down at that time because of negative mood. When people are in a positive mood, they will try to keep a system going. When they are in a negative mood they will defect from the system. See the EU and eurozone today for an unfolding example.

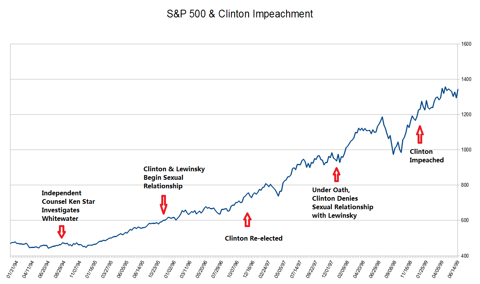

In contrast to Nixon, look at President Clinton's brush with impeachment:

Republicans thought they had the goods on President Clinton, but the public didn't care. They held on to Clinton and their stocks all the way into 2000. During this era, the WTO, NAFTA and the euro were launched in the midst of a global economic boom. It was the polar opposite to the 1970s in terms of social mood.

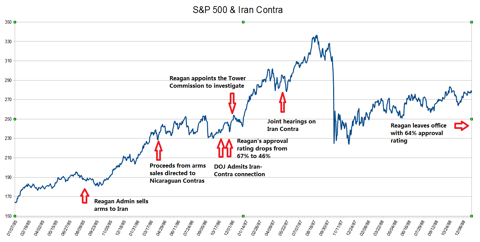

How about Iran-Contra? There was a stock market crash after all......

Iran-Contra came in the midst of a bull market and even though the market crashed, the crash was a short-lived affair-stocks didn't go into a bear market.

Now here's President Obama:

Obama administration scandals are just starting with the market at multi-year highs. There is enough scandal to drive Congressional investigations that will keep these scandals alive for months, if not longer. Therefore, the movement in the stock market could play a crucial role in how the public ultimate views these scandals. From the evidence I've seen, such as Michael Burry's commencement address in 2012 where has says he was audited week after this op-ed appeared in the NYTimes: I Saw the Crisis Coming. Why Didn't the Fed?, it appear the IRS scandal is much wider than presently thought and includes the targeting of individuals who publicly criticized any government policy.

Political Forecasts

Social mood will determine whether the public wants lawbreakers hunted down and punished, or whether they'd rather see Congress get back to business. Iran-Contra was serious, it caused Reagan's approval rating to fall, but ultimately people were in a positive mood. President Clinton lied under oath, but the social mood was even more ebullient in 1998. Republicans were completely out of step with the social mood and ended up harming themselves with impeachment. In contrast, Nixon's scandal broke during the 1970s bear market and social mood deteriorated as the scandal unfolded.

For investors, there are lots of issues at stake. The Federal Reserve's policies are increasingly unpopular with Republicans in Congress. Obamacare is set to take effect in 2014, but Republicans have a bills to delay its implementation or repeal it. Green energy and the Keystone Pipeline will be affected by the perceived strength or weakness of the Obama administration. In short, the world could be a very different place in 2015 if social mood changes course. Obamacare may be delayed and Republican led tax reform could be a major issue before Congress, or Obamacare could be the law of the land with current policies continuing until the end of Obama's term.

If the market continues rising, the scandals will be contained. Depending on the facts, officials could face sanction, but it will require intentional lawbreaking. It doesn't matter how much Obama's enemies scream or how justified they are in their pursuit of justice, the public will be in a positive mood and if Republicans press their case, it's likely to be a repeat of Clinton's impeachment.

If social mood is about to turn negative once more, the scandals will have greater impact. A decline from 1700 on the S&P 500 to 1300 over the next year or two will be a greater than 20% loss and the Obama administration will likely be mired in scandal. Washington will be divided by partisan rancor that will continue into the 2016 election. Most of Obama's policies will continue, but new legislation will prove difficult. Mood would favor the GOP in 2014 Congressional elections.

If we see a major bear market on the scale of 1973-1974, with the S&P 500 trading below 1100 in 2014 or 2015, then the Obama administration will be in serious trouble. Even Democrats will abandon the President (many will join Republicans in voting to delay or repeal Obamacare) and any tenuous link between the President and lawbreaking will be inflated into serious violations, if not of the law, then the public trust.

It is very early, but from the initial reports, there seems to be enough smoke to conclude one or more fires are present. If that's the case, the Obama administration will face serious political repercussions should social mood decline. Social mood is currently trending positive, but remains far more negative than at the 2000 peak in the stock market. Impeachment talk is silly at this point, but since I believe a 20% drop stocks is likely in the next 18 months, my outlook for the Obama administration is not bright. Watch the immigration bill, if it is defeated, it will be a sign that social mood is negative and working against Obama. If he can push it through, it doesn't mean he's past the scandals, only that he's still got enough positive momentum to continue pursuing his agenda.

Conclusion

Washington scandals will not drive the stock market lower. The stock market is driven by social mood and will rise or fall based on that mood. Whether a scandal becomes a major historic event or fades into the background will be determined by that social mood.

Investors should consider social mood when analyzing their market forecasts because the stock market is a reflection of mood. Put your political opinion aside and look at it objectively based on your forecast. Unless there is a smoking gun in Obama's hand, he will remain popular through a bull market and scandals will have a dampened effect. If in contrast there is a bear market, even a small scandal can be blown up into a major crisis that weakens the Obama administration.

You can extend the same analysis to foreign policy: if Obama is hamstrung with scandal, U.S. foreign policy is likely to suffer. To Europe: if mood in Europe declines, the UK will leave the EU and the eurozone will break apart. To Asia: if mood in Asia declines, Japan, China, Philippines, Taiwan and Vietnam will increasingly clash over maritime borders. On trade, if global mood declines, the world will increasingly prefer protectionist trade policies, restrict immigration and defect from global governance (such as climate change). If mood becomes positive, all of these trends will reverse and the Doha round of the WTO will move forward.

In sum, the stock market is telling us a lot more about the world than most of us think. It reflects social mood, and that mood can drive culture, politics and the economy.

Of course, a great criticism is that you can't forecast the market, in which case you can't use the market to forecast changes in politics or the economy. However, many investors and traders do make market forecasts and they have confidence in them. I suggest they consider the argument put forth by socionomics, that the information in their forecast is about more than just stock prices.

If you are interested in learning more about socionomics, check out Socionomics: The Science of History and Social Prediction.

English Defense League protests London beheading

Far-right clash with police near scene of killing

Running battles erupted in the streets, with youths and EDL activists in balaclavas throwing rocks at riot police, Channel Four reported. The Mail said bottles were thrown at the police.There weren't actual attacks, the perps were apprehended before they did anything.

Police formed a cordon and the activists dispersed soon after. Some then gathered at The Queen's Arms pub and sang nationalistic songs, the Mail reported.

Elsewhere, two men were arrested after separate attacks on mosques following the killing.

English Defence League retaliates following Woolwich terror attack

EDL leader Tommy Robinson said Islam is not a religion of peace and it is high time that law enforcers and lawmakers listen and understand the reason behind the British public's anger.

2013-05-22

Extreme immigration policies coming home to roost

Now that social mood is declining, the clear rifts between immigrants and the native communities are leading to a growing number of clashes, sometimes violent. The result will be a mix of authoritarian police state tactics to deal with volatile immigrant populations or anti-immigration policies that restrict the flow or deport foreigners.

Killing of gay man in NYC triggers protests; officials to increase police presence

2 more reports of anti-gay attacks in NYC following killing where man was taunted with slurs

New York City police say there have been two more reports of possible anti-gay attacks, following the killing of a gay man taunted with homophobic slurs.At least two of the three cases involved Hispanics, possibly immigrants.

Police spokesman Paul Browne says the attacks occurred Monday and early Tuesday.

In one, a 45-year-old man was attacked in Manhattan's East Village by a drinking companion who yelled an epithet.

In the second, two men were walking in lower Manhattan at about 5 a.m. Tuesday. Two other men yelled homophobic slurs in Spanish and attacked them. They were arrested on hate crime assault charges.

Stockholm burns as rioters battle police after three days of violence in immigrant 'ghetto'

An anti-immigrant party, the Sweden Democrats, has risen to third in polls ahead of a general election due next year, reflecting unease about immigrants among many voters.They will continue rising in the polls, count on that.

This post,Wait, there are riots in Sweden?, has a great chart explaining what Swedes really think of immigration, despite what they might say.

The left and their media allies are completely out of touch, see Reuters: Sweden's capital hit by worst riots in years

After decades of practicing the "Swedish model" of generous welfare benefits, Sweden has been reducing the role of the state since the 1990s, spurring the fastest growth in inequality of any advanced OECD economy.The issue is Muslim immigration from the Third World. Inequality was imported via immigration, it has nothing to do with economic policies and the general public knows it. The left is heading for a total collapse and they will leave an opening for far-right parties if legitimate concerns about immigration are waved off as xenophobia or racism.

While average living standards are still among the highest in Europe, governments have failed to substantially reduce long-term youth unemployment and poverty, which have affected immigrant communities worst.

The left-leaning tabloid Aftonbladet said the riots represented a "gigantic failure" of government policies, which had underpinned the rise of ghettos in the suburbs.

"We have failed to give many of the people in the suburbs a hope for the future," Anna-Margrethe Livh of the opposition Left Party wrote in the daily Svenska Dagbladet.

Reliably more right-wing RT presents the counter argument in ‘Multiculturalism failing’: Swedish PM pleas for order as riots engulf Stockholm suburbs

“This is a clear consequence of this multiculturalism politics that Sweden adopted around ‘80s and increased in the ‘90s... And this is not a unique one single occasion… we have had these ethnic-based riots against Swedish authorities. We have seen this in Western Europe, that is very sad, and I think we will see more of this, if we don’t change the politics,” the chairman of the Sweden’s National Democrats Party Marc Abramsson told RT.It is true, Sweden has bought the multiculturalist line hook, line and sinker and the result is on display before the world as negative social mood engulfs a fragmented society.

While not elaborating on the incident that caused the current riots, Abramsson said all such incidents have a common “problem beneath” – that is, the immigrants not identifying themselves with the country’s society, nor accepting the country’s authorities, sticking only to their own ethnic group.

“Sweden has been trying harder than any of the countries in Europe to try to push for integration. We have invested virtually billions from taxpayers’ money into it, we have tried everything that the scientists have presented – and still it’s not working,” the politician argued.

“They live in their area, and they feel the area is their own. And when the police arrive, they feel they are you intruding into their, sort of, ‘country.’ The police… who work in these areas, there have to be in two cars, one protecting the other. People are trying to maintain buildings, to have security guards, the fire department can’t work, they get attacked by angry immigrant youth that feel like they’re intruding into their own area, even though they’re trying to help,” Abramsson went on to say.

And finally, Islamic fanatics wielding meat cleavers butcher a British soldier in London

‘This British soldier is an eye for an eye a tooth for tooth. We apologise that women had to see this today, but in our lands our women have to see the same.’

In footage screened by ITV News, he added: ‘You people will never be safe. Remove your government. They don’t care about you.

‘You think David Cameron is going to get caught in the street when we start busting our guns? You think your politicians are going to die? No, it’s going to be the average guy like you – and your children.

‘So get rid of them – tell them to bring our troops back so we can ... so you can all live in peace.’

......The man, known only as James, said he and his partner saw two black men attack a young man aged around 20 in a Help for Heroes T-shirt like he was ‘a piece of meat’.

Fighting back tears, he told LBC Radio: ‘They were hacking at this poor guy, literally. They were chopping him, cutting him. These two guys were crazed. They were just animals.

'They dragged him from the pavement, dumped his body in the middle of the road and left (it) there.’

2013-05-21

AGW collapsed, but the stupidity continues

Greater tornado activity is a sign of global cooling. 1975 : Tornado Outbreaks Blamed On Global Cooling.

However, besides displaying that it takes awhile for people to get the message, the Senator's speech is also an unintended boost for secession.

2013-05-18

AGW collapses

A 2012 poll found that 43 percent of Americans believe scientists disagree on whether climate change is caused by human activities. A new study emphasizes just how wrong they were. Not only is there scientific consensus on the causes of greenhouse warming, there’s near-unanimity.Advocates of anthropogenic global warming (AGW) are no longer making scientific argument, which makes sense considering:

A sensitive matter

OVER the past 15 years air temperatures at the Earth’s surface have been flat while greenhouse-gas emissions have continued to soar. The world added roughly 100 billion tonnes of carbon to the atmosphere between 2000 and 2010. That is about a quarter of all the CO₂ put there by humanity since 1750. And yet, as James Hansen, the head of NASA’s Goddard Institute for Space Studies, observes, “the five-year mean global temperature has been flat for a decade.”This article in the Economist uses the phrase "maybe" "maybe not" a lot.

Temperatures fluctuate over short periods, but this lack of new warming is a surprise. Ed Hawkins, of the University of Reading, in Britain, points out that surface temperatures since 2005 are already at the low end of the range of projections derived from 20 climate models (see chart 1). If they remain flat, they will fall outside the models’ range within a few years.

My position has always been that one day climate science may give us a somewhat reliable model of the climate and it could show an impact by humans. As it stands today, however, there is not even a scientific justification for heading back to a pre-industrial economy in order to fight global warming. The amount of death and hardship that will definitely happen if climate change policies are enacted cannot be justified by "maybe, maybe not, we're not sure yet." AGW relies on climate models that assume knowledge man doesn't have yet. Wall Street thought it could hire mathematics Phds to model the financial economy, far less complex than climate, and it almost destroyed the global economy—and still might. We'll know the science is right when, as Vox says, it becomes engineering. When climate scientists can recommend a specific act that can be shown to deliver the predicted change in temperature, then we will be looking at a reliable model of the climate. Until then, they will fall back on political pressure and political arguments.

Finally, it might not matter if they could make a strong case for global warming today due to falling social mood. The climate change agenda requires a global consensus, and that consensus is collapsing by the day. Nations are finding more and more things to fight over; there's no way they will agree to global centralized control over the economy.

2013-05-15

It takes time

Did the U.S.S.R. disappear overnight? No. It took time, the exact amount of time for people to recognize, test, explore, and adjust their behavior. For some slower, and others more quickly. That is to say it took years, each piece unfolding one person at a time, one personal realization and event at a time in their own order. Once the nation collapsed, did it suddenly reform into the functional and rising state Russia enjoys now?Things will take far longer than anyone can predict and when change finally arrives, it will happen far faster than anyone can imagine. This is good news, in that there's a calm before the storm, plenty of time to prepare.

No. Again, it took time, decades of unfolding from 1991 until 2013, another whole generation, one "turning." Not until those who carried the template of the old ways passed away and new, younger people with new thinking replaced them. Not one of them could have stopped it or hurried it along although many tried, no different than any other time in history. As for the other guy, it’s always been clear that we’re all in this together. If your neighbors have a problem, then you have a problem whether down the street or in the world. This is why we all help each other best we can according to our abilities, in our own time.

What we as bloggers and far-seers have been trying to do is to change the aggregate, which cannot be done. The aggregate WILL change, but it can only change in its own schedule. We can continue to tell the truth, but after decades of status quo, we should not expect our words to change the world, our nation, or to some extent even our community. The only thing we can realistically change is ourselves with our own actions, and that is where all real change comes from, one person: one action at a time. 6 billion tiny events, tiny tipping points, changing minds who realize themselves one by one.

So what revolutionary act can you make today? If you read OfTwoMinds.com, PeakProsperity.com or similar sites, you already know the direction of history and what may be needed by you and the nation in the years ahead. What can you do to fill those gaps and prepare in your own life? Because the Wheels of History, although grinding exceeding slow, do get there in the end, made up of the decisions of billions of human actors. You may not be able to change your nation or the desperate situation we find ourselves in, but each of you can change yourself. You can make your own lifeboat in the midst of our own national challenge or "collapse." Only through that individual preparation could we find a million safety nets which prevent collapse.

And if that is all that’s asked of you, it’s good, for that’s all that’s possible.

Start today. It’s time.

Concretely, it doesn't matter today if the U.S. dollar is ultimately doomed and gold will rise in real value, what matters is how people behave should the U.S. dollar experience a major rally.

Death of the U.S. dollar greatly exaggerated; Historic U.S. dollar rally still likely

But as Bloomberg Businessweek reports, a lot of US Dollar bills are tucked away somewhere in Argentina (in stacks of $100 bills since the number in circulation has risen from 58% of the total to 62% since 2008). One table is a 2012 Fed paper on demand abroad for US currency shows net inflows to Russia and Argentina has increased by 500% since 2006 (compared to US demand up around 10%). In fact, demand for large dollar transfers to Argentina since 2006 has outstripped demand for dollar cash overall in the world.What will Japanese hoard if the yen hyperinflates? What will Europeans turn to if the euro dies? None of this is good for the dollar in the long-run, far from it since it will guarantee a U.S. debt crisis by raising the value of U.S. debt relative to the global economy. But those looking for hyperinflation are betting against the odds, as the more likely path to U.S. dollar hyperinflation is first through hyperdeflation, the other side of which is the hyperinflation of other fiat currencies.

The U.S. dollar is the core of the global financial system and global powers, including China, will seek to preserve it as long as possible. As each nation passes through hyperinflation, however, they become freed from the global financial system via devaluation. At that point, the cost of launching a new financial system have been paid up front. As each nation goes through hyperinflation, it puts the U.S. dollar in a more untenable situation and makes a nation more likely to defect to a new system. Since gold will likely be a part of a new financial order, even if there is deflation it is wise to obtain physical metal, but the ultimate denouement of the U.S. dollar may be years away.

2013-05-14

Asian and European social mood deterioriates

Taiwan threatens Philippines with sanctions

Taiwan has demanded Manila apologise and compensate the victim's family or face a freeze on the hiring of its nationals.

It also asked the Philippines to bring to justice the coastguards responsible and start negotiating a fisheries agreement.

Taiwan threatens to hold naval drill near Philippines

Taiwan stepped up pressure on Manila Tuesday, saying it would conduct a naval drill in waters near the Philippines if Manila did not officially apologize for the killing of a Taiwanese fisherman.

Taiwan has demanded the Philippines apologize by midnight Tuesday (1600 GMT) over the killing of the 65-year-old fisherman by coastguards last week or face a potential freeze in sending workers to the island.

Meanwhile in Europe as Social Mood Darkens in Europe, Especially France, as Eurozone Economy in Freefall

A PEW study on European Attitudes shows social mood is darkening in the Eurozone, but especially in France.

In America, political scandal is beginning, but relative to Asia and Europe the mood is this:

Is Benghazi about to blow sky high?

Now, as far as Obama / Huma Abedin / Valerie Jarrett etc actually wanting Ambassador Stevens dead, to terminate the end of the very dirty Libyan arms to Syrian AQ programs, I can’t speculate. Obama is not competent enough, I’m thinking.I didn't quote the beginning part because it seemed sensational and off target, but I had heard discussion of arms deals previously. Karl Denninger has also noted this, such as in Hint: Quit Blowing Obama:

But for sure, the ambassador going to unsecure Benghazi on 9-11 of all days stinks to me of a setup. You can bet Stevens would have told the Turks, “No, 9-11 is not a good day for us,” and stayed in Tripoli behind many high and thick walls. For him to go to dangerous Benghazi on 9-11 means the Turks totally insisted, but why would they care about the meeting date, unless they were in on a “hit” as the Judas goat?

Alternatively, ordering Stevens to meet the Turks in Benghazi on 9-11 may have come from down OUR chain of command. Stevens seems to have been wearing two hats as ambassador and CIA arms shipper. Moving between more-secure Tripoli, the Benghazi “consulate,” and the CIA “annex.” So orders to him might come down the State or the CIA commo channels, or both. I am unclear on his job title and true position, but either the CIA or State sends him final instructions. How this works with “dual-hatted” ambassadors, I haven’t a clue.

The press will not hold the government's feet to the fire on Benghazi, because then we have to admit that Chris Stevens was basically assassinated with our government's permission, and one must then ask the obvious question: What the hell were we actually doing over there that led those folks to want to kill him? Was it an attempt to "take back" arms we had given a group of people known hostile to the United States? That leads to some damned uncomfortable places if you're on your knees before Obama with his pants around his ankles, doesn't it?This sounds like conspiracy talk right? Just right-of-center guys who are throwing out ideas, including some which paint the President in the worst possible light.

But then today I see this: An alternative explanation for the Benghazi talking points: Bureaucratic knife fight

First, some important context: Although the ambassador was killed, the Benghazi “consulate” was not a consulate at all but basically a secret CIA operation which included an effort to round up shoulder-launched missiles. In fact, only seven of the 30 Americans evacuated from Benghazi had any connection to the State Department; the rest were affiliated with the CIA.Well this seems to be news: it wasn't a State Department mission, but a CIA mission to round up weapons.

So, from the State Department perspective, this was an attack on a CIA operation, perhaps by the very people the CIA was battling, and the ambassador tragically was in the wrong place at the wrong time. But, for obvious reasons, the administration could not publicly admit that Benghazi was mostly a secret CIA effort.The Washington Post looks at the story entirely from the inside baseball of politics, but this raises the issue of what was really going on. It seems it's widely known by those following the story that this was as CIA mission to collect arms and that the attack likely was related to this mission, perhaps these were even the terrorists armed by the U.S. who killed the ambassador. Now it makes sense why this was covered up......but I get the sense from a cursory following of the story that most Americans, including many in the media, aren't aware of the real story.

The talking points were originally developed by the CIA at the request of a member of the House Intelligence Committee. Interestingly, all of the versions are consistent on one point — that the attacks were “spontaneously inspired by protests at the U.S. embassy in Cairo,” a fact later deemed to be incorrect.

How Fake Exports Caused The Yuan Rally

Chinese exporters on the brink of bankruptcy have turned to currency arbitrage to stay alive, distorting Chinese trade data and the Chinese banking system.

Gold Lied, Inflation Died

This is not the picture of a healthy credit market. Instead, it is the picture of a credit market where the federal deficit is the only thing preventing a full on depression. There is no inflation in the total supply of credit without the obscenely large annual federal deficit and the outstanding amount of credit dwarfs money supply.

Gold Lied, Inflation Died

2013-05-13

Chinese exporters import gold as part of currency arbitrage schemes

The secret false trade arbitrage arbitrage the three model dismantling

import and export data reported in April soon as he announced the the false trade debate was detonated.

The interpretation of the data, close to the "absurd": China's exports in April year-on-year growth accelerated to 14.7%, 10% higher than the year-on-year in March, well above market expectations of 9.2%. Imports grew by 16.8%, higher than market expectations of 13%. These two data again disappointing trade data conflict with South Korea and Taiwan.

SG interpretation, data compared with Taiwan, mainland to Taiwan's exports growing faster than 51.9% (49.2% vs. -2.7%), while the mainland to Taiwan import growth the fast 58.6 percentage points (55.7% vs. -2.9% )! Among them, the most "do not fly" data import and export data. Where the water?

"Even if the import and export air line?

Popular RMB loans backed by a million can be rolled into billions of deposits, zero-risk, welcomed the consultation. "Along a microblogging clues, the reporter in Wuhan, a medium-sized foreign trade enterprises in Hong Kong on behalf of the identity, called the Fu surname "intermediaries" phone. Listen that what he wanted, he started Detailed lawful arbitrage entire process.

"First of all, business license and financial statements and other documents, before other bank line of credit, the fastest two weeks by the bank's credit investigation

company size requirements? "

real trading background, the registered capital more than 100 million yuan to review by not less than 50 million yuan deposited HSBC outlets, issuing letters of credit guarantees by the domestic branch of the HSBC Hong Kong counterparts highest operational efficiency, three days around each spreads about annualized 0.9%. "

reporter questioned whether it is necessary to provide true declarations with "Free Trade Zone, a day trip to deceive the public. The opposite came a laugh.

Customs to really check, Shenzhen Free Trade Zone, the first ones to suffer in the end you are not to do foreign trade? Documents, the contract can be false, why waste logistics costs. "

According to the body in Shanghai, "intermediaries" said the SAFE The reason why the introduction of four measures to strike hard re-export trade, which dealt with a number of non-foreign trade enterprises doping. "Some manufacturers engaged in the wholesale and retail profit-jealous, never export to customs, and this pierce the windows of paper."

intermediaries Fu said that he preferred Class A enterprises to direct their export declarations, contracts or invoices able to prove the authenticity of the transaction documents and any other kind of direct bank in the process of payment, import and export exchange earnings without online verification. "Excellent credit record B enterprises (trade foreign exchange receipts and payments by the bank to the implementation of electronic data verification), can also be involved in less than 100 million yuan arbitrage."

However, the Hang Seng Corporate and Commercial Banking, said Lin Yansheng accepted to our inquiries, Hong Kong after receiving the onshore guarantee, the Bank had not had actual contact, requires companies to submit all the documents again, does not exclude to send personnel to the Free Trade Zone or mark personally inspect the declaration of goods take up to a month.

Senior trade sources, the bank is generally more stringent review in the credit phase, the territory branch successfully issued a letter of guarantee, foreign counterparts deny the possibility of the RMB trade finance is almost zero.

100 million yuan loans from Hong Kong banks, and the latter in urgent need of reflux. Fu agent said the bank account manager will provide Hong Kong or offshore company registration, money circulation at least two or more times in order to apply for a trade reflux.

"If often to settle trade with the Mainland, Hong Kong companies will be better." A Hong Kong company registration agency believes that offshore corporate easy to give the impression of leaving tax evasion, from the regulatory point of view, the Hong Kong company's concern about the relative low. According to regulations, the Hong Kong banking sector RMB funds through trade channels, pay for the imports of goods from China directly back to the Mainland.

The offshore renminbi loans after repeated account to go, quite covert. Finally, Habitat housing just signed a new trade contracts with domestic parent company, the procurement of raw materials, gold and the name of a new bank, the completion of the trade under reflux.

Three models arbitrage

arbitrage secret expansion of trade data according to Merrill Lynch's report of May 10, arbitrage model can have several.

First, starting from the fourth quarter of last year, the offshore market for RMB assets rose, which led to the offshore RMB / USD (offshore RMB trade), compared to onshore RMB / USD (onshore RMB trade) are much more expensive. The peak in January, the offshore RMB onshore RMB expensive 0.6%. Therefore, offshore and onshore RMB between the arbitrage opportunities. "It looks very complicated, in fact, very simple arbitrage." Said Bank of America Merrill Lynch, for example:

arbitrage in the Mainland to borrow $ 1 million for 6.2 million yuan onshore exchange rate of 6.20, and then imported from Hong Kong gold and other goods of low logistics costs and pay by RMB 6.2 million yuan flows to Hong Kong as an offshore RMB, by Hong Kong partner, offshore exchange rate of 6.15 into dollars, get $ 1,008,130. Finally, then the original imported gold exports to Hong Kong partnership and profit of $ 8.13 thousand U.S. dollars (without regard to logistics and other costs), the end of the process.

However, there are people in the industry, imports of gold involved 13% of the value-added tax, the actual profit will be deducted for tax expenditures, arbitrage profits will be badly affected.

Bank of America Merrill Lynch judgment, the benefits of import and export of gold is small size, high value, and therefore is an ideal subject of such arbitrage. According to the data of the Customs and Excise Department, the first quarter of recent years, the Mainland to Hong Kong's gold exports rose year-on-year to 300%, the mainland from Hong Kong's gold imports soared 175%, which can be a gold cross-border arbitrage between the Mainland and Hong Kong mobile strong evidence.

The second model is offshore arbitrage between the onshore RMB interest rate. This arbitrage is very simple, is based on the arbitrage between the two different interest rates. Arbitrageurs can borrow offshore RMB of low interest rates, side-by-side into the high interest rates in the onshore RMB.

Arbitrage interest rate of 6% in the Mainland to borrow 100 million yuan two weeks, and then the interest rate of 3% in the bank, to require banks to issue letters of credit. The letter of credit, arbitrageurs partner or a related company of RMB 100 million yuan a year to get loans from banks in Hong Kong. Then arbitrageurs from the Mainland's exports of some low-volume, high-value goods to its Hong Kong partner, and receivables of 100 million yuan, and 100 million he returned to the bank. How to make a profit? RMB deposit interest rate and the cost of the offshore renminbi financing is his profit. Currently, after deducting the costs spread of 70 basis points. 1 billion two weeks Gross profit 700,000 250,000 loans a month cost to be deducted, and ultimately profit 450,000.

The third model is arbitrage between the spreads and the appreciation of the renminbi. This is the most complex model in onshore RMB offshore U.S. dollar, as well as between the shore RMB / USD and offshore RMB / USD.

For example, in Mainland China loan of 100 million yuan, an interest rate of 6% loan-to-two weeks, $ 1 billion to the bank to deposit into a one-year time deposits, the interest rate of 3%, let banks issue letters of credit, assuming that offshore USD / CNY 6.15, outside related enterprises in Hong Kong at 2% interest rate to borrow $ 16,260,000. Domestic enterprises through the export of gold or high-tech products, dollar loans reflux. At this point in the shore exchange rate of 6.2, to remove the loan interest, profit 56 million yuan in profits into time deposits. Year, fixed deposits of 1.036 billion yuan, net profit of about 360 million within one year 2% appreciation of the RMB against the U.S. dollar, the profits to be $ 592,000.

Bank financing "wade"

If the rhythm is faster? If the flow of capital and then "change" mean?

According to this reporter, the flow of capital arbitrage, has entered the bank financing, reap higher profits than the deposit.

Huang Qun (a pseudonym), a logistics company in Shenzhen Free Trade Zone to work in the past year, he has been involved in rumors of Shenzhen Futian Free Trade Zone, drove business now.

"Free Trade Zone and Hong Kong exchanges belonging to the re-export trade, not taxable," said Huang Qun, "so the cost is very low, as long as there is sufficient demand and resources, you can do great." Huang Qun said "demand" is refers to the Free Trade Zone of warehousing enterprises, foreign trade settlement limits through the re-warehousing business, business loans backed by a bank to obtain low-interest funds from Hong Kong. These funds transferred to the mainland, mainly through the purchase of financial products arbitrage.

The reporter of a Free Trade Zone, warehousing enterprises of foreign trade foreign exchange financing operational processes: (registered enterprises) in the bank set up a margin account and a financial account and associated information; preparation of related documents submitted to the bank, according to the amount required by the bank to handle the knot and payment procedures.

Margin account deposits can be recycled by T2 (2 working days cycle time) to do, T1 (1 working day cycle) to do. "Said Huang Qun.

For example, foreign trade warehousing companies in the margin account deposit 100 million margin, in accordance with the 20 working days of the month and T2, a month corresponds to one billion foreign capital inflows. This session, the Bank in accordance with 4 ‰ -5 ‰ "drove" from knot and payment amount to the bonded area of foreign trade warehousing company "dividends", "you can get up to six thousandths.

Ping An Bank financial markets related to the reporter said, "a lot of profit-taking after the inflow of hot money, real estate, the stock market can be, but the bank financing is a relatively way to gain a solid and flexible way."

According to the Ping An Bank Financial Markets Department sources, the bank in this session not only a margin deposit to increase the sales of financial products, but also a lot of money in the middle income "within the warranty credit business," the bank's enthusiasm is also very high. " In fact,

after the frenzy

, Free Trade Zone and day trips, or exchange differences arbitrage, is not a new trick. New, in the context of the internationalization of the RMB, the new channel opened up, so that the return of the offshore renminbi loan funds more smoothly.

"Since the fall of 2012, China's trade data, especially the export data has been seriously distorted." Merrill Lynch chief economist Ting Lu believes.

HKMA data show that in March of this year, trade finance has also become the major promoter driven growth in the size of loans, compared with December last year, trade finance grew by 20.1% to HK $ 460.2 billion, compared with the same period last year, this an increase of 22.4%.

In October last year, between the onshore and offshore RMB exchange differences are very small, and by the fourth quarter of last year, conditions began to mature. "Ting Lu pointed out that, on the one hand, the RMB against the U.S. dollar appreciation again, the Chinese economy has begun rebound, on the other hand, offshore, in the onshore RMB against the U.S. dollar exchange differences to expand, expand the arbitrage profit margins, and people gradually mastered the secret of how to use the difference between onshore and offshore exchange rates and interest profit.

Spreads and exchange differences driven, arbitrage activity is rampant, the export growth bubble inflate. Ting Lu, after reasonable adjustments, from January to April this year, the growth rate of exports, but up and down 5%, much lower than the 17.3% increase data show.

(Trade distortion) reflecting the survival of small and medium-sized enterprises in the Mainland increasingly difficult, and the deteriorating economic situation in the Mainland, forcing enterprises to take the risk. "Hu Yifan, chief economist of Haitong International.

In the short-term cross-border trade RMB settlement of the case, the decline of the Industrial environment, so that the charm of arbitrage activities greatly increased, foreign trade enterprises, the fastest three days to achieve a return of 0.9%, will undoubtedly become more attractive following the real estate financial products.

"The excessive growth of RMB trade finance to cover the illegal arbitrage worry; currency appreciation is expected to attract foreign capital influx, the domestic document fraud introduction of offshore RMB against the countries to open 'within loans backed' to support domestic enterprises to go out of mind, its side effects, in turn, will hinder the the the RMB capital liberalization process. "CITIC Bank (International) business chief economic strategist Liao Qun.

For any similar space market spreads, copy a similar pattern is not impossible.

"Taiwan's trade with some water." Hu Yifan, Taiwan imports year-on-year increase of up to 55.7% in April, exports and imports of high-tech products year-on-year by a significant increase of 25.5% and 41.7%, but most other categories of products The level of growth is significantly weaker, and even showed a year-on-year downward trend or a weak single-digit growth, this may also reflect forged import and export invoices.

Ting Lu also pointed out that the same problem, the fourth quarter of last year and the first quarter of this year, the growth rate of exports of the mainland to Taiwan are 32%, while Taiwan Customs statistics show that in the same period, the mainland increase in imports from Taiwan were only 2% and 6 %.

The arbitrage activity itself is an important prerequisite to ensure market efficiency and capital mobility can not kill all arbitrage activities. "Deutsche Bank Greater China chief economist Jun Ma pointed out that, to the U.S. dollar offshore market, for example, 96% of the transactions arbitrage, hedging or investment functions, only less than 4% for the actual trade settlement. Therefore, capital arbitrage itself is the only way for a national financial markets from a closed to an open.

Since the inevitable question is placed in front of the regulators, how to solve the problem?

Regulatory authorities must be in the process of transition, the gradual opening of the capital account, can not let the arbitrage activities in the trade under development is too fast. "Ma Jun, otherwise, the import and export business entities indulged in capital operation, not only caused the trade figures virtual The increase in hot money from foreign exchange to offshore renminbi inflows, but not conducive to the national management of liquidity.

Hu Yifan funds indulge in arbitrage activities, but also to the domestic monetary authorities issued a real signal - only 4% of the market price of RMB loans given, Mainland approximately 6% of the level of interest rates is clearly too high.

"With the expansion of the market, arbitrage is bound to be more, will be more obvious, it is now in the hands of concessions to make the difference." Hu Yifan, in addition to strengthen customs links check file, cargo and other measures, regulatory The layer also needs to conform to market pricing consider adjusting the level of interest rates.

Impeach Obama? It's all in the DJIA

If stocks fall, Obama will be impeached or his administration will be effectively shut down by investigations. The IRS scandal is critical because the IRS is used to implement Obamacare. If conservative groups were targeted for audits and harassment, it means conservatives (or any group out of favor with the current administration) could see their healthcare denied. On top of Benghazi and Fast & Furious, this is a wicthes brew. The only reason scandals aren't shutting down the administration today is because Republicans do not control the Senate. The way things are going, that is unlikely to remain the case. With both Houses, all the scandals of the prior 6 years will be investigated thoroughly. Eric Holder and other officials will not be able to remain in office.

If the Fed were all powerful, you could say only the Bernank could save him. But even Bernanke isn't powerful enough to reverse social mood. The question is whether this boom survives through the 2014 elections or not. Obama might survive impeachment like Clinton because Republicans may gain power in the same manner and ignore the social mood clues, fighting the old battle. However, the long-term Elliot Wave forecast suggests if thinks break, they will break down severely and Obama will not make it out.

Q: How did Clinton survive all those scandals?Excerpt from Why Was Ronald Reagan, Born 100 Years Ago, So Popular?

Prechter: Actually, anyone who doubts my socionomic thesis need only consider the amazing case of Bill Clinton. As Congress got ready to vote on his ouster, the bull market resumed. The higher the market went, the more feelings against him waned. His popularity remained high, and it saved him. It was the same reason that no one cared when Reagan faced the Iran-Contra scandal. The Lewinsky scandal and lies to the American public didn’t hurt Clinton’s popularity because the president’s popularity reflects social mood, and its best meter, the stock averages, were still on their way to final all-time highs and record valuation in December 1998, the month of his impeachment by the House. That month, Clinton’s approval rating was 73%, which turned out to be his all-time high. Public mood is the key to his resilience, and that comes from the unconscious part of the mind, not the part that weighs facts.

Q: The lies and his behavior didn’t matter?

Prechter: Nope!

Q: What about the next guy?

Prechter: The next president, and maybe even one or two after that, should watch out. They will have to ride out the slide into a deflationary crash and depression. The party of the person who is in office during the worst of it will be devastated politically.

Q: You apparently don’t take sides.

Prechter: No, my analysis is non-partisan.

Q: Can you apply the rules of Elliott to political analysis?

Prechter: The guideline of alternation seems to apply. It has a specific technical meaning in wave formation, but also pertains to social trends. For example, you might recall that Richard Nixon won re-election in a landslide in late 1972 at the peak of a bull market. Despite everyone’s high hopes, he was hounded as a law-breaker and ultimately driven from office in August 1974 by the social mood reflected by the bear market. Bill Clinton took office with the market at a new all-time high amidst strong popularity, a Time “Man of the Year” cover, and high hopes for his performance. Like Nixon, he was hounded as a lawbreaker as the market corrected in 1994. Instead of Watergate, it was Whitewater. But one was a Republican and the other a Democrat. The specifics alternate. The essence repeats.

Update on the Slow Death of Democracy

Detroit insolvent, EM Kevyn Orr says

Emergency Manager Kevyn Orr says the city of Detroit's cash-flow crisis makes it "insolvent" and unable to borrow more money to mask over debts being made worse by skipping millions in payments for retiree pensions and health care.Much more to the story. I expect this will become a huge issue in the coming days and weeks because there are dozens of cities in similar situations, not as bad as Detroit perhaps, but bad enough that they will need to take similar steps. If Detroit takes out "holy grail" items like retiree pensions and healthcare, other cities will take advantage of the precedent. This is a huge, huge battle.

After 45 days on the job, Orr's initial assessment of Detroit's perilous finances is laid bare in a 41-page report to be delivered today to state Treasurer Andy Dillon.

Calling it "a sobering wake-up call about the dire financial straits the city of Detroit faces," Orr said he will use the report as a baseline for paring down the city's $15.6 billion in debt and long-term liabilities.

Orr, a Washington, D.C., bankruptcy attorney, did not use the word "bankruptcy" anywhere in his report but said the city is "insolvent" and has "effectively exhausted its ability to borrow" after years of issuing long-term debt to pay its bills. Previously, he has said he hopes to avoid a Chapter 9 filing.

The report hints that city employees who were not hit by last year's wage reductions could face pay cuts in the near future and that Wall Street bondholders will be asked to take a haircut to relieve a city that shelled out $133 million in debt payments last year on a $1.23 billion budget.

Orr also says he will evaluate "options to reduce or eliminate certain health care costs for both active and retired employees" in light of a $5.7 billion unfunded health care benefit for 18,500 retired city workers and 10,000 active employees.

"No one should underestimate the severity of the financial crisis," he said Sunday in a statement.

......The Detroit General Retirement System and Police & Fire Retirement System claim to have been 83 and 100 percent funded, respectively, as of June 2011. But Orr and a team of consultants aiding the restructuring of city government are beginning to question mathematical assumptions used to determine the value of the funds.

The city's June 2011 report showed the pensions having a $646 million accrued unfunded liability. But Orr said the market value of the two pension funds' assets — such as real estate — were more than $1 billion less than the actuarial assumptions.

If you're wondering how they got into this mess, just look to the idiocy of union leaders who had the prior government's ear:

Ed McNeil, a representative for the city's largest union, AFSCME Council 25, said the rising legacy costs are nothing new and as the city continues to privatize and reduce its workforce, it is losing funds that could have been paid back into the system.By this logic, increasing payrolls exponentially would result in an exponential rise in tax revenue.

"If you stop hiring people to pay into the system, then your money is gone," said McNeil, whose union represents about 2,000 city workers. "This is a 'set up to fail' situation."

2013-05-12

The view from the top

Diamonds to Blazers: Gatsby Mania Inspires Retailers

Inspired by the glitz and glamour of "The Great Gatsby's" 1920s backdrop (and hoping to capitalize on some free press), several retailers have launched collections to help consumers to live it up West Egg style.No movie could better represent the mid-Depression mood better than The Great Gatsby. In the 1930s, comedies were popular during the 1934-1937 recovery. Today, after trillions in global central bank printing, the perfect movie comes out and plays up the perfect angle. It is an opulent feast for the eyes, a glitzy take on the 1920s timed perfectly for new stock market highs. Yes, the 1920s are here again! But for how long?

2013-05-11

Social mood: Mystery Aircraft Frightens Quincy Residents

Social mood may explain a lot of the fear, but this is interesting: a city councilor asked the FAA if it was law enforcement, and they said they couldn't say. Then he asked was it at least something the people don't need to be worried about, and the FAA said, "I can't tell you that."

Yuan Arbitrage Replaces Trade as Exporters Go Bust; Endgame Begins for China Bubble

Chinese exporters on the brink of bankruptcy have turned to currency arbitrage to stay alive, distorting Chinese trade data and the Chinese banking system.

2013-05-10

Here Comes the Global Rebalancing; What Happens to USD/XXX If XXX Goes to Zero?

ZeroHedge points us to two stock charts in Name These Two Markets. It shows the Merval and the Nikkei, the Argentinian and Japanese stock markets going vertical as their currencies head lower. Here's a look at the two currencies:

This isn't yet hyperinflation, but this is what hyperinflation looks like at the beginning. Furthermore, Argentina is already in hyperinflation: Global Dollar Demand Keeps Inflation Tame At Least In U.S.

Inflation is just getting started in Argentina. The rate is officially about 10%. Unofficially, it’s about 30%. Officially, you can trade a dollar for 5.4 pesos. Unofficially, you’d be a fool to do so. The black market rate is eight pesos to the dollar — and more.Looking at the chart above, it implies a more than 50% drop in the exchange rate for the peso. Technically one can quibble about where the line is drawn on hyperinflation, but Argentina is getting to the point where the debate ends. I go with the shorthand of 50% annual inflation, which is really close for Argentina because at these levels, 50% is not far from 30%. Past that point, a nation runs the risk that people will flat out abandon the currency, sending inflation into the hundreds or thousands of percents.

Argentina is another study in failed economic policies, but its impact will be limited due to the size of the economy. In contrast, the decline in the yen is critically important because it is an exporting powerhouse. As the yen declines, it will increase its exports at the expense of competitors such as South Korea and Germany, and this will have secondary effects on exporters such as China. The decline in the yen will accelerate the global rebalacing because it will destroy the export economies. If Japan moves towards hyperinflation, exporters such as Germany and South Korea have two choices: let their currencies appreciate and suffer a depression (SK exports account for 60% of GDP) or join in the devaluation. In the case of Germany and China, they may have no choice because of their fragile financial systems. Major deflation will ultimately lead to hyperinflation as the financial system fails and requires massive central bank intervention to save.

The big wildcard is China.

The yuan is moving in the wrong direction. China targets hot money inflows with new forex rules

Indeed, the hot money is showing up as faster money supply growth: China April New Yuan Loans, Money Supply Exceed Estimates. Something will have to give in China.

All the while, the U.S. dollar and U.S. assets will absorb capital seeking a safe haven. It doesn't matter that gold should be a safe haven in this scenario because so many investors have gotten it wrong. The gold bulls nearly all expect U.S. hyperinflation and a major U.S. dollar rally could crush the gold bulls, while the rest of the market is anti-gold and will look to other assets. Therefore, I can foresee a massive decline in gold prices if this scenario plays out. It will be the buy of at least three lifetimes because a U.S. dollar bull will be temporary as the U.S. will eventually succumb to the deflation too, but investors may continue selling gold even when it reaches insanely cheap levels.

Meanwhile in Asia......

Japan protests over Chinese article on Okinawa sovereignty

Taiwan protests to Philippines over fisherman's death

Taiwan demanded compensation from the Philippines Thursday over the killing of a crew member of a Taiwanese fishing trawler which allegedly came under fire from a Philippine government boat.According to the Chinese reports, the Philippine vessel strafed the ship.

Japanese Government Bonds Halted Limit Down; Yields Spike To 10 Week High; Worst Day In 5 Years

South Korea Joins India-to-Europe Rate Cuts for Growth

Australian dollar rebounds after rate cut sell-off

China Yuan Hits New High on PBOC Guidance

Things are starting to pick up the pace. China is going to be squeezed by the plunging yen and now the won is likely to follow. The Australian dollar will start weakening as well. The rise in the yuan is coming at the worst possible time, as the U.S. dollar sets out on its own rally against other major currencies. China may be headed for a serious deflationary crisis.

2013-05-09

Obama impeachment a matter of the stock market?

It's clear now that President Obama and Secretary of State Hillary Clinton lied to the public, either directly or through subordinates, about the attack in Benghazi. The full story may never come to light, with speculations of arms trafficking at this point uninvestigated.

Bracken: Did Obama Withhold Cross-Border Authority?

Stevens seems to have been wearing two hats as ambassador and CIA arms shipper. Moving between more-secure Tripoli, the Benghazi “consulate,” and the CIA “annex.” So orders to him might come down the State or the CIA commo channels, or both. I am unclear on his job title and true position, but either the CIA or State sends him final instructions. How this works with “dual-hatted” ambassadors, I haven’t a clue.Between the existing lies and cover-ups, if it were revealed that the State Department was arming terrorists, it would surpass the current level of scandal, which is already at Iran-Contra levels.

But Stevens meeting the Turks at the unsecure Benghazi “consulate” on 9-11 stinks to me of a deliberate setup

No one today is predicting impeachment for Obama or Clinton, but there's enough dirt here to justify it. Therefore, we need to look to social mood. Both Clinton and Reagan survived major scandals during rising social mood. Currently, social mood is on the uptick. If social mood were to tumble, then the public has all the ammunition they need to take it out on the leadership.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/base/copper-d.gif)